Many readers will recognize Ronald Reagan’s famous maxim that: “Government is not the solution to our problem; government is the problem.” Some will even recognize his vehement opposition to Lyndon Johnson’s Medicare proposal, before the program was passed into law:

Many readers will recognize Ronald Reagan’s famous maxim that: “Government is not the solution to our problem; government is the problem.” Some will even recognize his vehement opposition to Lyndon Johnson’s Medicare proposal, before the program was passed into law:

“We are faced with the most evil enemy mankind has known in his long climb from the swamp to the stars. There can be no security anywhere in the free world if there is no fiscal and economic stability within the United States.”

Reagan even warned at one point:

“If this program passes, behind it will come other federal programs that will invade every area of freedom as we have known it in this country until we wake to find that we have socialism… You and I are going to spend our sunset years telling our children and our children’s children what it was like in America when men were free.”

Pretty overwrought words, and clearly an inaccurate prediction. But that’s not what I want to write about now. Instead I want to talk about happened when Ronald Reagan was president, when he passed what David Blumenthal and James Morone describe as “the largest Medicare expansion in decades.” What was this expansion, and how did Reagan come to embrace it? …(Read more and view comments at Forbes)

Check out this WHYY Radio Times segment I participated in on health care price transparency:

Check out this WHYY Radio Times segment I participated in on health care price transparency:

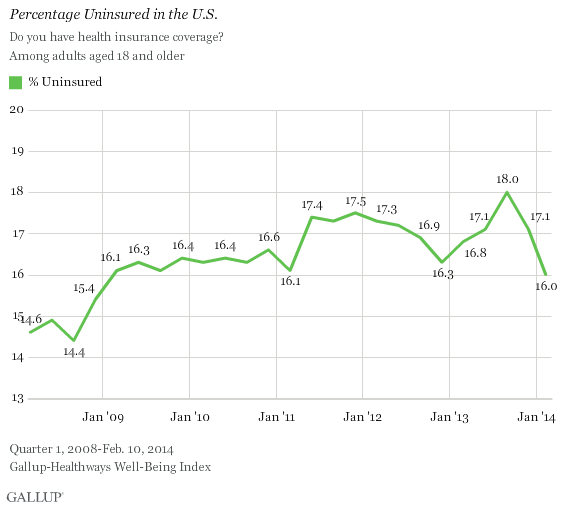

It is always important to remember that healthcare and health insurance are two very different things, and neither of them is a guarantee of good health. Therefore, when people talk about Obamacare providing people with medical care, we have to remember that it primarily provides people with health care insurance. And as I have

It is always important to remember that healthcare and health insurance are two very different things, and neither of them is a guarantee of good health. Therefore, when people talk about Obamacare providing people with medical care, we have to remember that it primarily provides people with health care insurance. And as I have  A quote from Far From the Tree I thought I’d share:

A quote from Far From the Tree I thought I’d share:

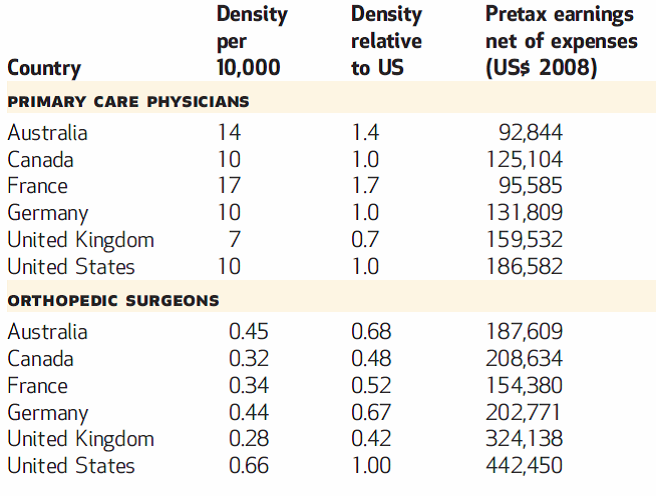

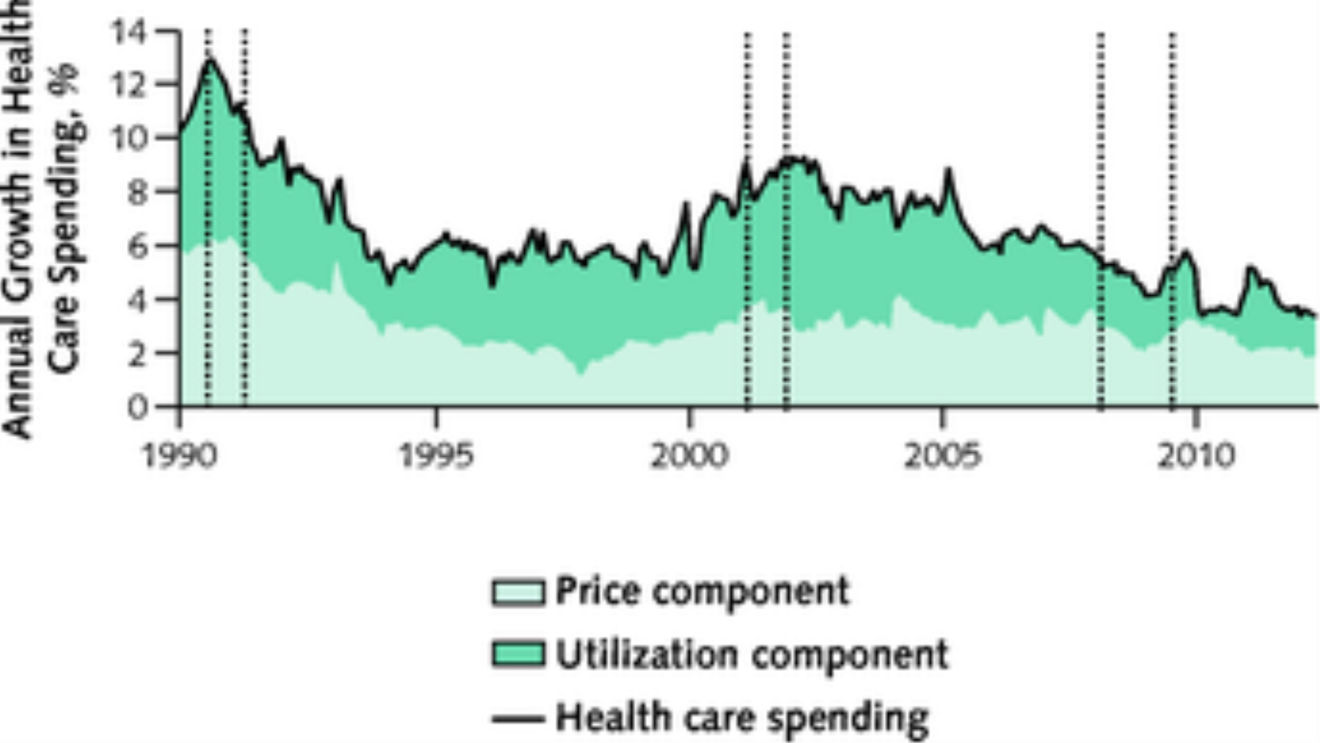

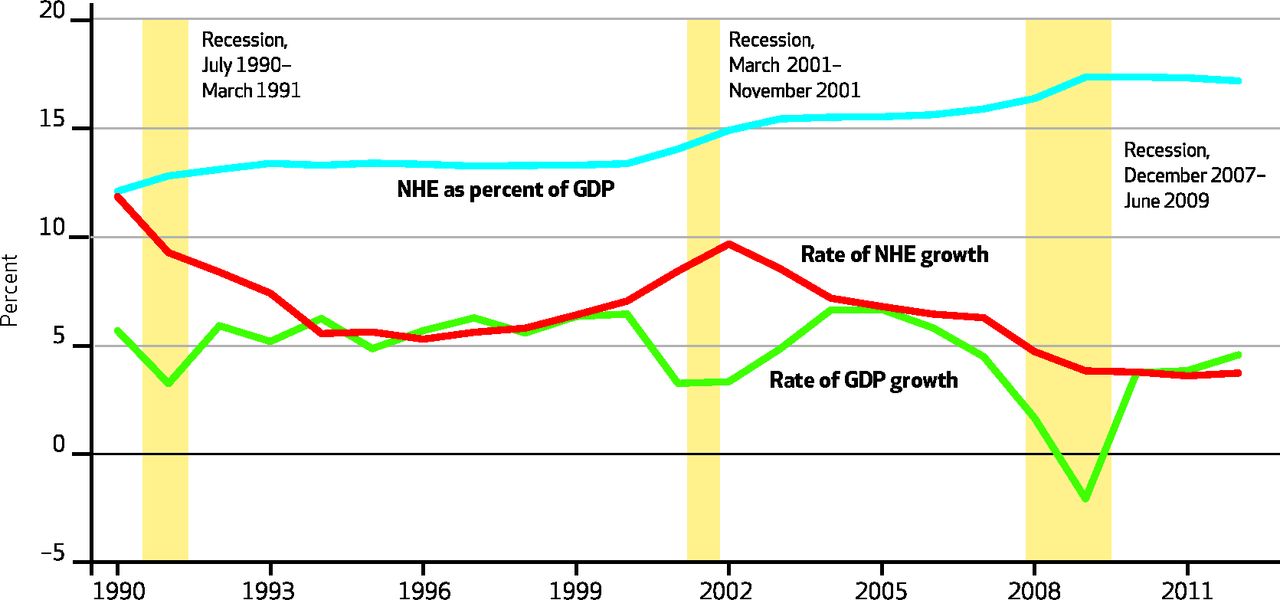

We all know that healthcare costs in the U.S. are too high. But why is American healthcare so expensive? Some experts blame the desire for profit. Russell Andrews, a neurosurgeon and author of Too Big To Succeed

We all know that healthcare costs in the U.S. are too high. But why is American healthcare so expensive? Some experts blame the desire for profit. Russell Andrews, a neurosurgeon and author of Too Big To Succeed