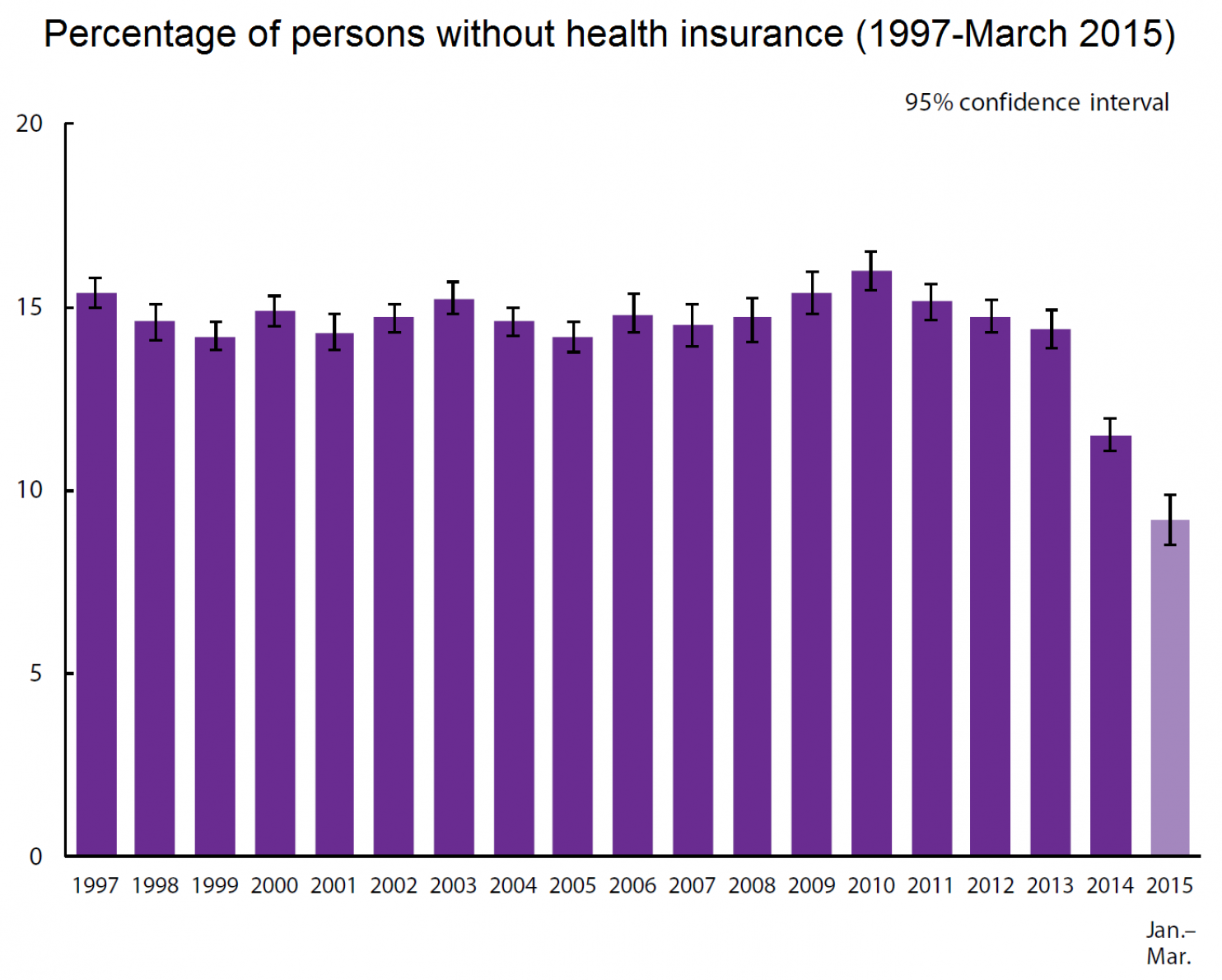

Thanks again to the Kaiser Family Foundation for keeping all of us informed about important healthcare statistics. Here’s a relatively recent snapshot of how the percent of Americans lacking health insurance has fluctuated since the 1970s. The effect of Obamacare on the statistic is undeniable:

Health Insurance Trends in One Picture

Republicans Hate Obamacare so Much, They Refuse to Benefit from It?

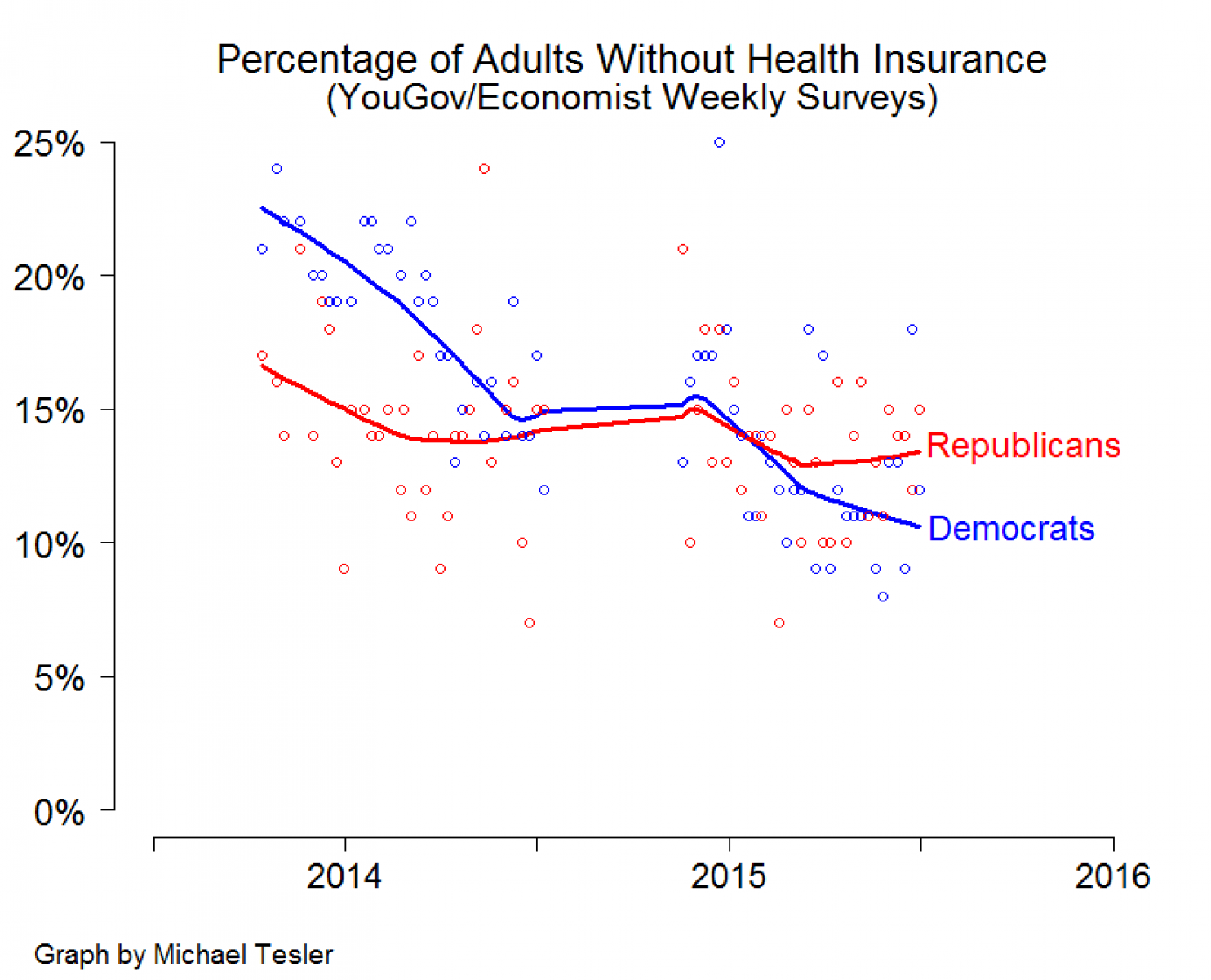

Here is a chart from the Washington Post, showing the percent of people lacking health insurance over the last few years. For a long time now, a higher proportion of Democrats have been uninsured than Republicans, with low income and minority communities experiencing a disproportionately high uninsurance rate. But since Obamacare has come into effect, a lot of Democrats have signed up for health insurance who never had it before. But Republicans have lagged behind, and now it looks like they might be experiencing higher uninsurance rates than Democrats:

To their credit, at least Republicans aren’t being hypocritical!

Obamacare Going into a Death Spiral?

Folks around the country are signing up for health insurance right now on the Obamacare exchanges, and some are seeing a very confusing set of options, with price hikes, or maybe not price hikes, and with subsidies, or maybe not such generous subsidies. Here is a great take on what’s happening in NC:

Folks around the country are signing up for health insurance right now on the Obamacare exchanges, and some are seeing a very confusing set of options, with price hikes, or maybe not price hikes, and with subsidies, or maybe not such generous subsidies. Here is a great take on what’s happening in NC:

Obamacare Customers Look for Better Deals as Prices Rise

Cathy Allen pays less than $5 a month for health insurance through Obamacare’s Health Insurance Marketplace. But to keep her plan next year, her costs would have skyrocketed to $150, said her husband, Richard Allen.

Then the Allens got a call from Cumberland HealthNET, a local health care nonprofit, as the staff checked back with people they initially had helped enroll.

“I was glad they did,” Allen said. “She called me and told me to come in and they would try to help us find a better plan.”

After sitting down with a marketplace navigator, the Allens were able to find a plan that would meet her needs for about a dollar more each month.

This is a common scenario for people who already are enrolled in Obamacare plans, say local application counselors and health insurance navigators.

The prices for some Obamacare plans have gone up by double digits, in large part because not enough healthy people have enrolled to help offset the costs of older, sicker enrollees. Some experts see that as a challenge to the long-term viability of the controversial health insurance program.

Most marketplace customers will automatically be re-enrolled in coverage if they don’t actively update their application or change plans by Tuesday. Those who let that date slip by without double-checking their plans may be paying a higher premium come Jan. 1.

“Many people think they are stuck with it,” said Diasmil Pena, a navigator at Cumberland HealthNET. “They don’t know their options.”

In some instances, said Megan Epert, another navigator there, such customers will cancel their plans altogether because they don’t believe they can afford it. Others, she said, get the renewal letter from their health insurance company but assume it will automatically renew at the same rate.

“We’re advising consumers to come on in, check that out, go on the marketplace, to ensure that they’re getting the insurance they want for the premium they want,” said Francine Chavis, a navigator with Legal Aid in Robeson County. Often, there are comparable plans for a lower price, she said.

Janel Lewis, a certified application counselor with Stedman-Wade Health Services, said she’s had success helping existing customers avoid large premium increases.

“We’re seeing that with everyone who brings a notice to us, we’re able to input their information and end up walking out paying less,” she said.

Last year, she said, many customers favored the flexibility afforded by PPO plans offered by Blue Cross and Blue Shield of North Carolina, the only provider to offer plans in every county during the first year of enrollment.

“That made the difference for some people,” she said.

But this year, she said, Cumberland County residents are flocking to United Healthcare.

“You don’t really have as much to choose from,” she said.

Many consumers really like their insurance company, Pena said, “but it’s just unaffordable for them, so they had to end up switching plans.”

For Cathy Allen, an affordable plan meant sticking with United Healthcare. She’ll now have co-payments for doctor appointments, but “it’s better than not having health care at all,” Richard Allen said.

At 57, Cathy Allen has cirrhosis of the liver and other chronic health problems, and before the Affordable Care Act, she had been uninsured, he said.

“If it weren’t for the Affordable Care Act, she’d probably be dead by now,” her husband said.

“Now she’s got it under control.”

Market ‘in flux’

Marketplace consumers are not alone in the seemingly constant change they experience.

“This is a market in tremendous flux,” said Peter Ubel, a Duke University professor specializing in health policy and economics.

“It’s a market that ultimately depends on everybody being in it.”

But many healthy people have been staying away from Obamacare.

“That leaves insurance companies with very expensive enrollees,” he said.

“And so they raise their premiums, and more people wonder if they should buy insurance.”

Blue Cross and Blue Shield of North Carolina, the largest insurer in the state, requested marketplace rate increases averaging nearly 35 percent.

To read the rest of the article, please visit The Fayetteville Observer.

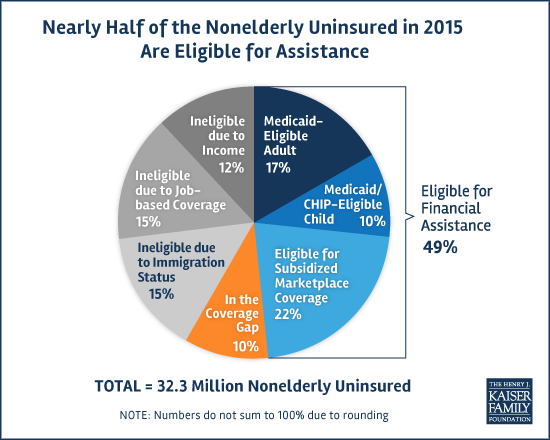

Unnecessarily Uninsured

Obamacare Isn’t Helping the “Tweeners” Much Yet

The Affordable Care Act has done a lot to increase the proportion of Americans with health insurance. I’ve posted a lot of those figures in the past. But here is some data, published by a former student of mine, showing that the law doesn’t seem to be having a huge impact yet on people ages 26 through 44.

The sharp decline in the uninsurance rate people ages 19 through 25 are direct result of the law expanding parental coverage for people in this age group. Insurance companies now have to allow parents to keep their kids on their insurance up to age 26. But what explains the larger decline in uninsurance among people 45 and older, compared to those 26 through 44?

I expect it is health. At least according to my experience, as people get older, they experience more health problems. That makes it that much more important to have health insurance. By contrast, many people in their 20s and 30s are relatively healthy, and are therefore probably more willing to go without health insurance. That is a problem. We need everybody to have insurance, so the people in their 20s and 30s subsidize those in their 40s, 50s and 60s. The individual mandate was supposed to accomplish this.

It hasn’t done so yet.

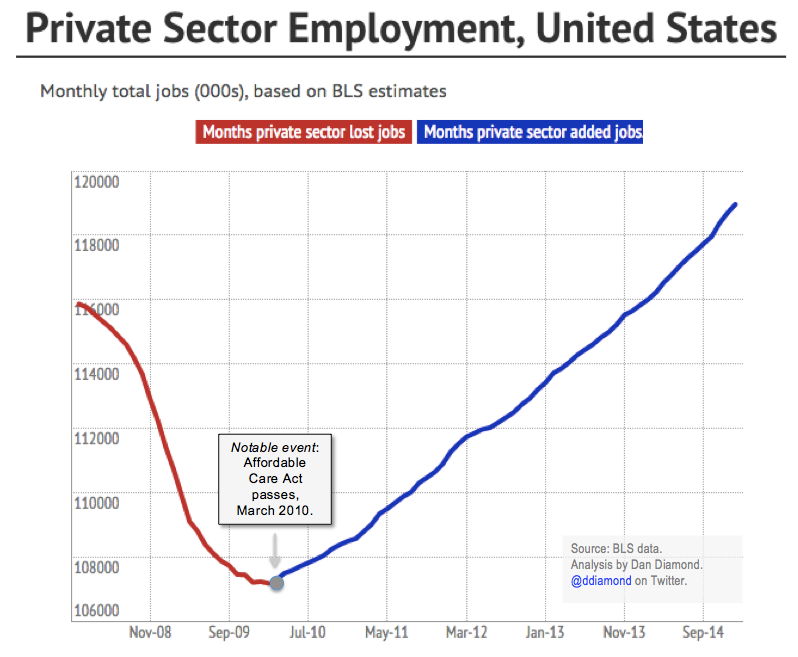

So Much for the Job Killing Effects of Obamacare

Look What Obamacare Has Done Now

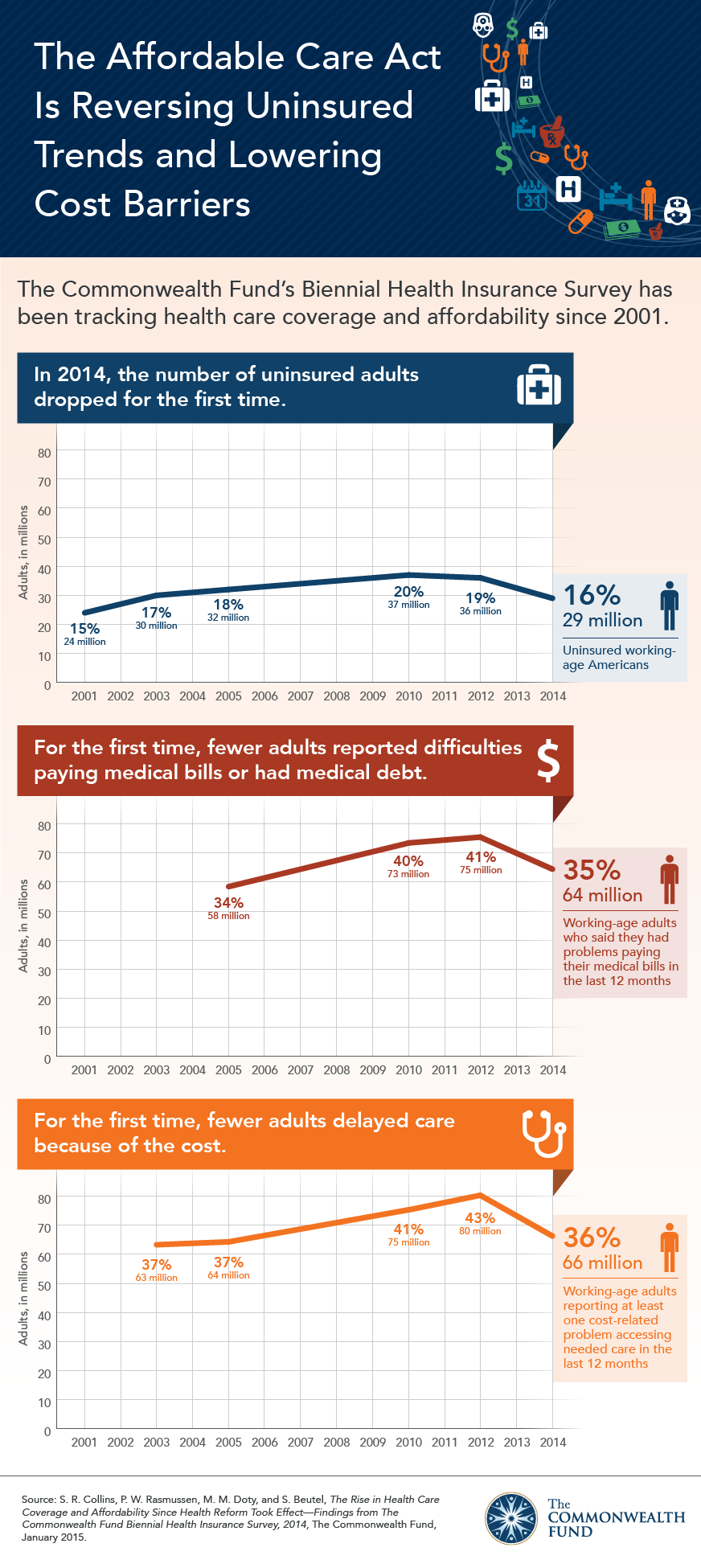

The percent of Americans without health insurance has dropped precipitously in the last few years, thanks in large part to the Affordable Care Act, a.k.a. Obamacare. This is especially true in those states that, in accordance with the law, expanded Medicaid eligibility. Here is a picture of some recent data:

This is really good news, and the figures are likely to continue improving over the next few years. But they will improve a lot more if holdout states agree to expand Medicaid.

I’m not holding my breath.

Disliking Obamacare despite Benefiting from It

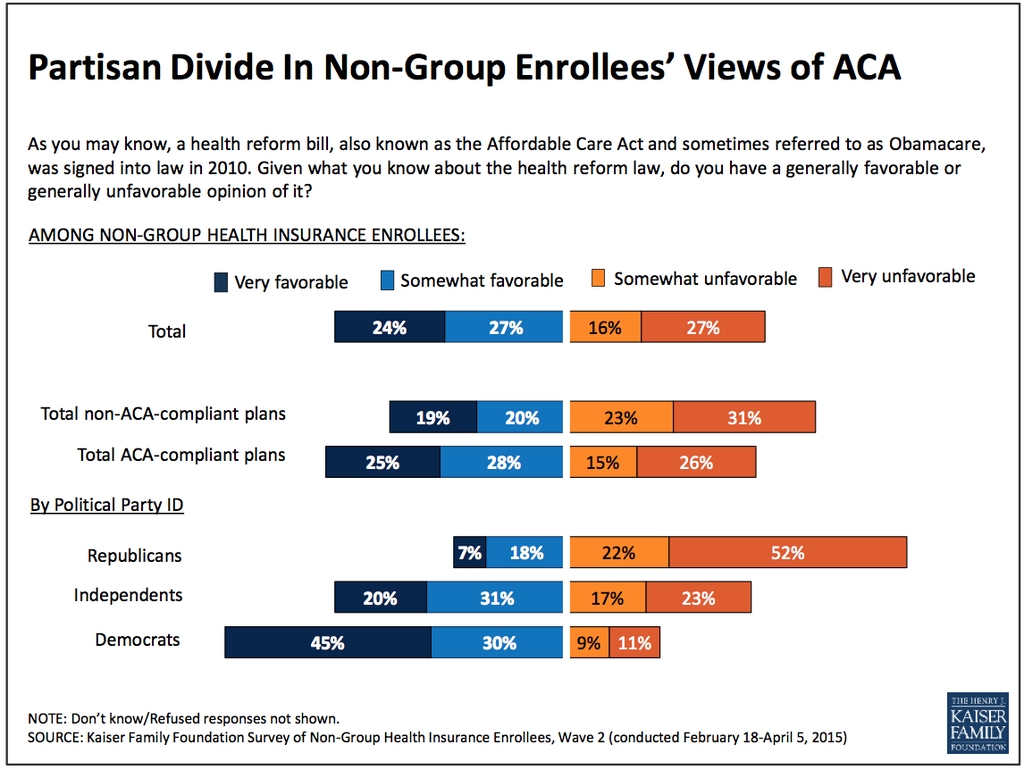

No surprise to learn that the majority of Republicans dislike Obamacare. But did you know that the majority of Republicans, who SIGNED UP FOR INSURANCE through Obamacare, still dislike the law? That’s one finding from a recent Kaiser survey:

Notably, they dislike the law even though they LIKE THEIR INSURANCE:

I look forward to the day when we can get beyond our attitudes towards this law, and join together to improve our nation’s healthcare system.

Health Insurance Is About Financial Security Too

People like me, trained to be physicians, have pushed hard to promote health insurance in the United States because we believe, with some evidence to back up our claims, that good health insurance promotes better health. When people don’t have insurance, they delay necessary medical care for too long, and their health suffers as a consequence.

But probably the most direct benefit of health insurance is financial. When people have good health insurance, they are less likely to be burdened by medical costs. That is one of the findings revealed in a recent survey published by The Commonwealth Foundation. Here is a wonderful info graphic illustrating some of their results: