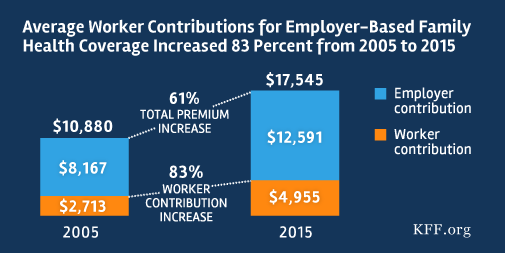

In case you missed it, I am recirculating a picture put together by the Kaiser Family Foundation , which reveals two unsettling facts about health insurance in United States.

First, the cost of employer-based health insurance has risen 61% since 2005. When health insurance premiums rise, salaries don’t. That’s a problem.

Second, worker contributions have risen even faster than overall premiums, increasing 83% over this period of time.

We have tremendous income inequality in this country that arises for a whole host of reasons. Healthcare costs are making this problem worse, by diverting money away from people’s take-home pay in order to cover the rising costs of health insurance.

Sorry if that is a bit of a downer.

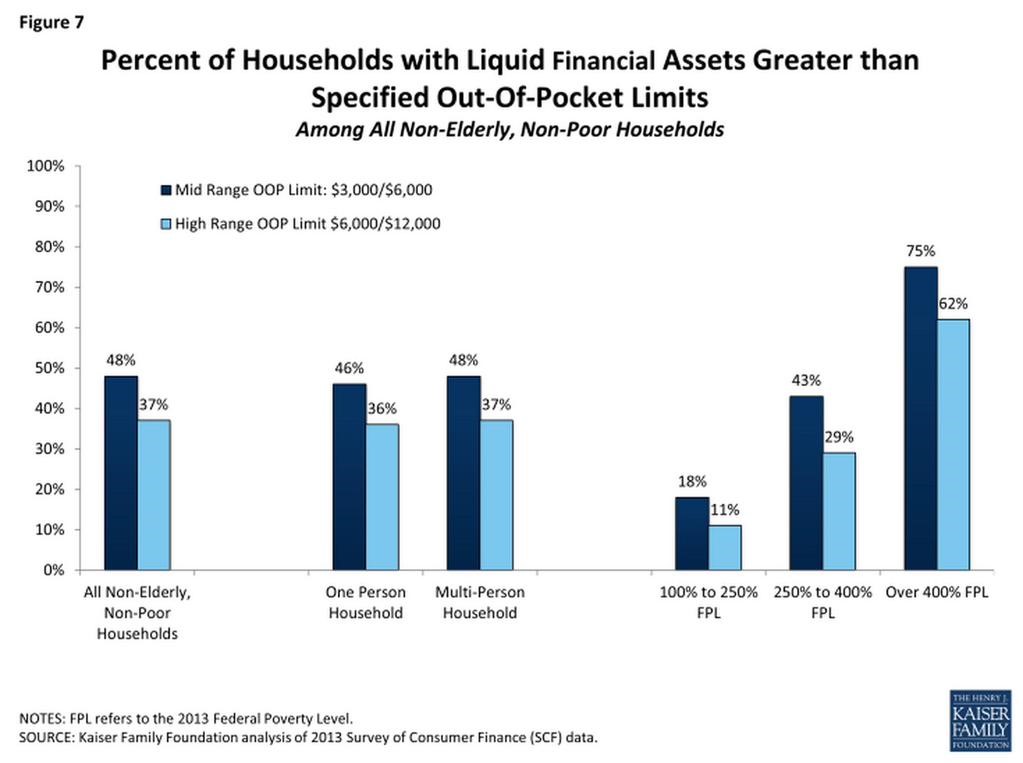

At Risk of Financial Ruin

According to figures from the Kaiser Family Foundation, one of the best sources of reliable health policy information, the majority of Americans will have to exhaust all their “liquid assets” to cover medical expenses, if they reach the maximum out-of-pocket costs allowed by their health insurance.

The moral of this story is simple: stay healthy!

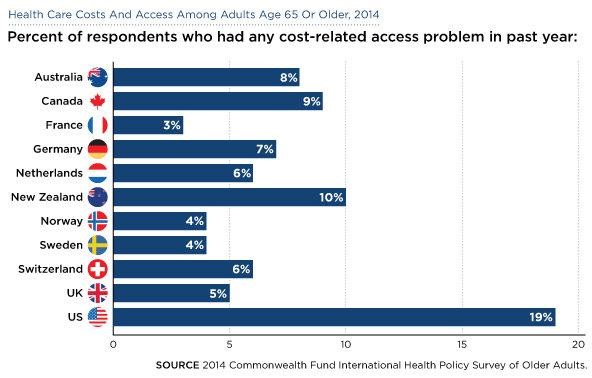

Medicare, Schmedicare

For more than half a century now, the United States has stood out among its peers in the developed world for having the largest percent of its citizens living without health insurance. But once you turn 65-years-old in America, the government has you covered. Right?

Maybe not so much. Because even after people enroll in, they still end up with lots of out-of-pocket costs, costs that often burden them to the point where they can’t afford to receive care. Take these data from the Commonwealth Fund, which show the percent of people who have difficulty obtaining medical care because of cost:

Once again, the U.S. stands as an outlier nation. Sometimes it’s not good being number one!

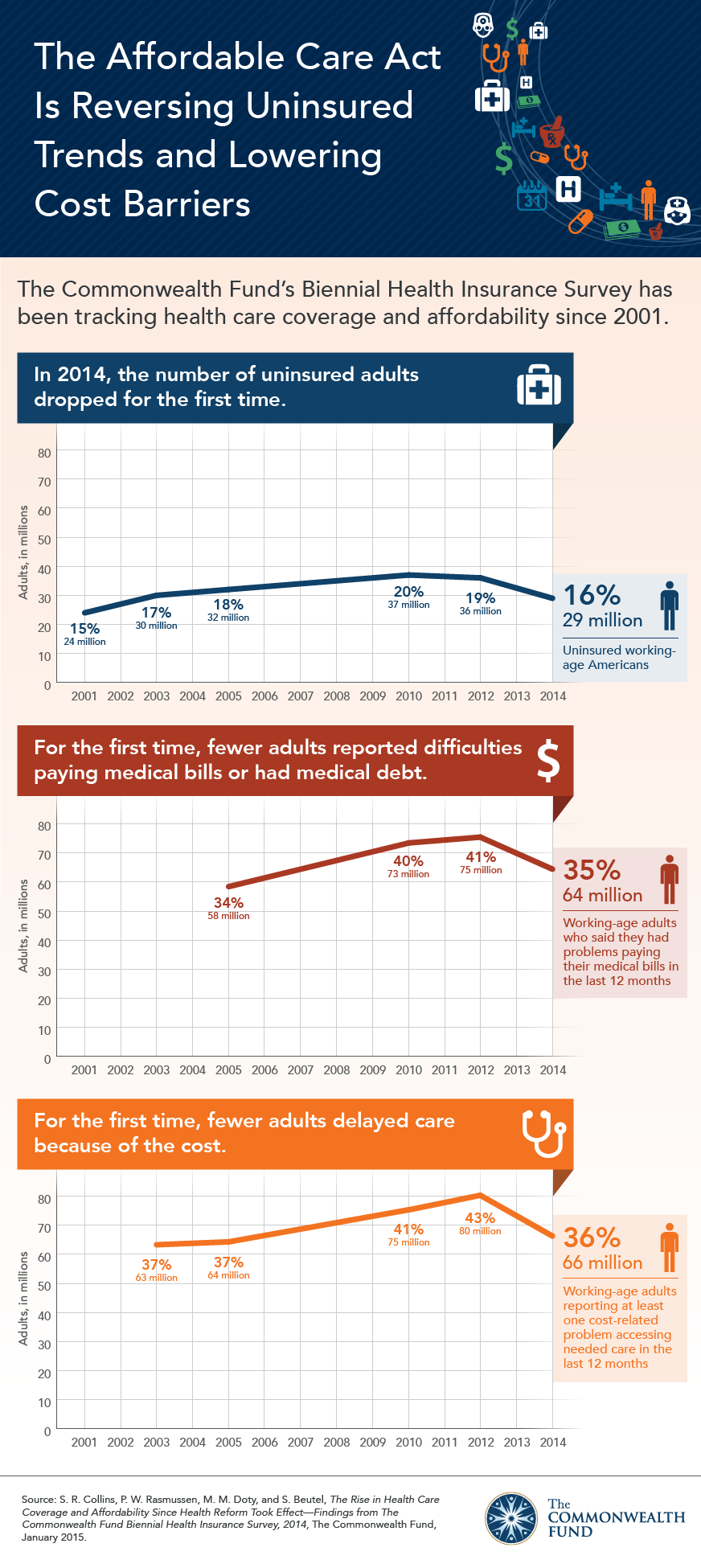

Health Insurance Is About Financial Security Too

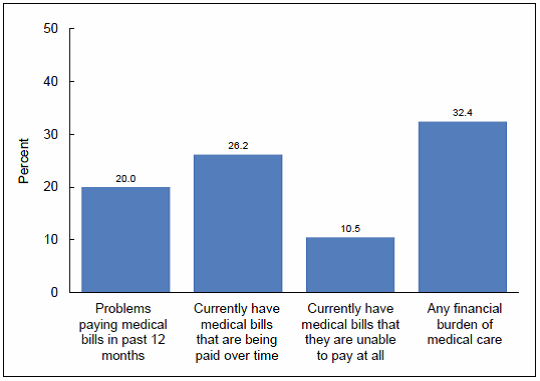

People like me, trained to be physicians, have pushed hard to promote health insurance in the United States because we believe, with some evidence to back up our claims, that good health insurance promotes better health. When people don’t have insurance, they delay necessary medical care for too long, and their health suffers as a consequence.

But probably the most direct benefit of health insurance is financial. When people have good health insurance, they are less likely to be burdened by medical costs. That is one of the findings revealed in a recent survey published by The Commonwealth Foundation. Here is a wonderful info graphic illustrating some of their results:

The High Price of Affordable Medicine

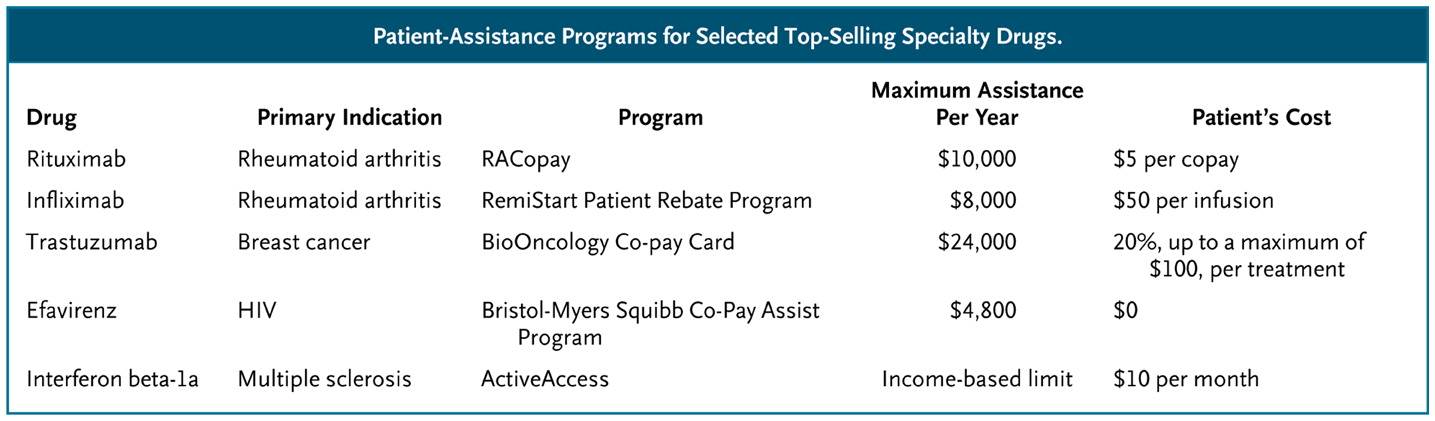

In the old days, blockbuster drugs were moderately expensive pills taken by hundreds of thousands of patients. Think blood pressure, cholesterol and diabetes pills. But today, many blockbusters are designed to target much less common diseases, illnesses like multiple sclerosis and rheumatoid arthritis or even specific subcategories of cancer. These medications have become blockbusters not through the sheer volume of their sales, but as a result of their staggeringly high prices. Tens of thousands of dollars per patient, per year.

In the old days, blockbuster drugs were moderately expensive pills taken by hundreds of thousands of patients. Think blood pressure, cholesterol and diabetes pills. But today, many blockbusters are designed to target much less common diseases, illnesses like multiple sclerosis and rheumatoid arthritis or even specific subcategories of cancer. These medications have become blockbusters not through the sheer volume of their sales, but as a result of their staggeringly high prices. Tens of thousands of dollars per patient, per year.

The high cost of such blockbuster specialty drugs creates significant financial burden for many patients. When a drug costs $90,000 per year, and a patient pays 10% of that cost, we are talking about a serious chunk of change. Not surprisingly, as these out-of-pocket costs rise, so too do the rates of “non-adherence,” medical lingo for “the patients didn’t take the medicines that I, their doctor, thought they should take.” Non-adherence used to be called noncompliance, which sounded too paternalistic. Now some experts are shifting to an even less judgmental language of “medication abandonment.” Indeed, here is a picture of the likelihood that patients will stop taking specialty drugs as a function of their out-of-pocket costs:

What can we do to help patients afford these medications?

(To read the rest of this article, please visit Forbes.)

Proven: People Don't Take Medicine They Can't Afford

Cholesterol pills are one of the great medical advances I’ve witnessed during my professional career. I am talking specifically about a category of medications called statins, drugs like Lipitor and Pravachol. These drugs have prevented probably hundreds of thousands of heart attacks and strokes. Only one problem with these drugs, however: statins won’t help people who don’t take them. And according to a study in the prestigious Annals of Internal Medicine, when physicians prescribe trade versions of statins rather than generics, the extra cost dissuades many people from filling the prescription.

Cholesterol pills are one of the great medical advances I’ve witnessed during my professional career. I am talking specifically about a category of medications called statins, drugs like Lipitor and Pravachol. These drugs have prevented probably hundreds of thousands of heart attacks and strokes. Only one problem with these drugs, however: statins won’t help people who don’t take them. And according to a study in the prestigious Annals of Internal Medicine, when physicians prescribe trade versions of statins rather than generics, the extra cost dissuades many people from filling the prescription.

If physicians want to help their patients, they need to prescribe affordable versions of accepted medical interventions.

The study was led by Joshua Gagne, a pharmaco-epidemiologist (a person who lives and breathes hardcore data on medications and population health) at Harvard (an up and coming university located, I think, somewhere near Boston). Gagne and colleagues analyze data from Medicare patients who got their prescription benefits from CVS Care Mark. (To read the rest of this post and leave comments, please visit Forbes.)

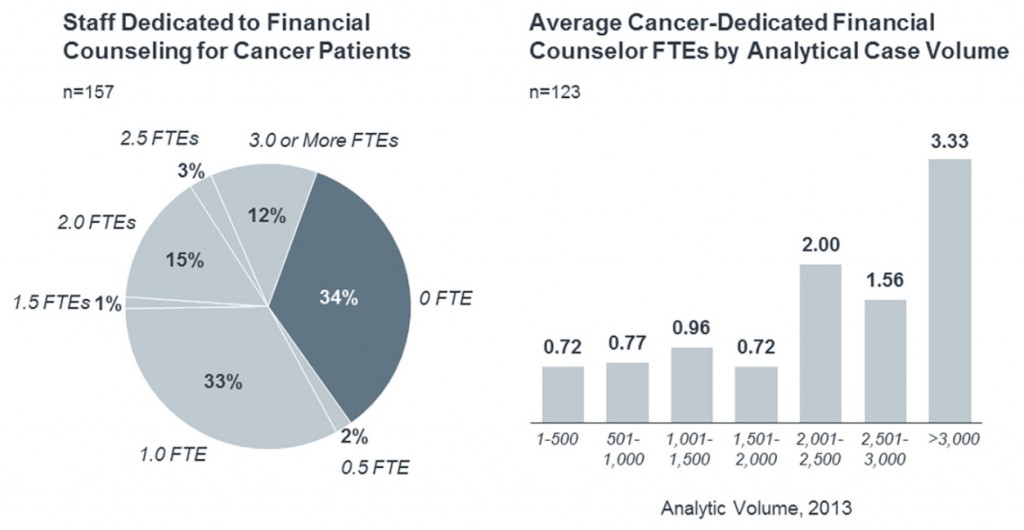

Financial Counseling for Cancer Patients: A Growth Industry?

A former student of mine who now works at the Advisory Board recently emailed me some figures her company put together, offering a snapshot of how many people are being hired in oncology practices to help patients with their financial concerns:

I am very eager to see what these figures look like over the next couple years. I will be surprised if these numbers don’t grow significantly. Cancer-related treatment costs are a really big deal!

Discussing Financial Toxicity in Oncology Settings

The American Society of Clinical Oncology is one of the leading specialty organizations for physicians who take care of patients with cancer. A reporter from ASCO just wrote a nice piece, in which she questioned me to go into more detail about the challenge of discussing cost of care with oncology patients. I thought I would share that with you:

The American Society of Clinical Oncology is one of the leading specialty organizations for physicians who take care of patients with cancer. A reporter from ASCO just wrote a nice piece, in which she questioned me to go into more detail about the challenge of discussing cost of care with oncology patients. I thought I would share that with you:

High costs of cancer treatments can be an “undisclosed toxicity” that can harm a patient’s overall health and well-being, according to an article in The New England Journal of Medicine. High medical bills can not only cause stress and anxiety but may also compel patients to cut back on spending for other basic needs—such as food, leading to less healthy diets—or to take medications less frequently than prescribed.

“This is a very frequent cause of nonadherence,” the article’s lead author,Peter A. Ubel, MD, Professor of Business, Public Policy, and Medicine at Duke University, Durham, North Carolina, said in an interview with The ASCO Post. “It is a medical problem. Patients may not be showing up for tests or taking their pills because they can’t afford it. Dr. Ubel also tackled the issue of physicians rarely discussing medical intervention costs in an op-ed article he wrote for The New York Times.

Not Always Easy to Know

“Because treatments can be ‘financially toxic,’ imposing out-of-pocket costs that may impair patients’ well-being, we contend that physicians need to disclose the financial consequences of treatment alternatives just as they inform patients about treatments’ side effects,” Dr. Ubel and colleagues wrote…(Read more here)

Toxic Side Effect: High Out-of-Pocket Health Care Costs

When is the treatment worse than the disease? When the high costs associated with care become a financial burden for patients and in many cases prevent them from protecting their health, contends Peter Ubel, MD, a 2007 recipient of a Robert Wood Johnson Foundation (RWJF) Investigator Award in Health Policy Research.

When is the treatment worse than the disease? When the high costs associated with care become a financial burden for patients and in many cases prevent them from protecting their health, contends Peter Ubel, MD, a 2007 recipient of a Robert Wood Johnson Foundation (RWJF) Investigator Award in Health Policy Research.

“We have reached a point where patients’ out-of-pocket health care costs can have more of a negative impact on their quality of life than some illnesses,” Ubel says, citing the thousands of dollars in deductibles, co-pays, coinsurance, and other charges that even burden people with health insurance. The potential financial devastation of the uninsured is also increasingly a factor, especially for people facing serious diseases.

Bringing Costs Out of the Closet

Ensuring that patients understand the possible side effects of a surgery, medical treatment or prescription drug is considered standard medical practice. Unfortunately, that’s not the case when it comes to warning patients about what they may have to pay for care. Engaging patients in a candid conversation about treatment costs is critical at a time when out-of-pocket costs for breast cancer treatment, for example, may run as high as $55,000, Ubel argues… (Read more at Robert Wood Johnson Foundation)

On the Financial Burden of Paying for Medical Care in the US

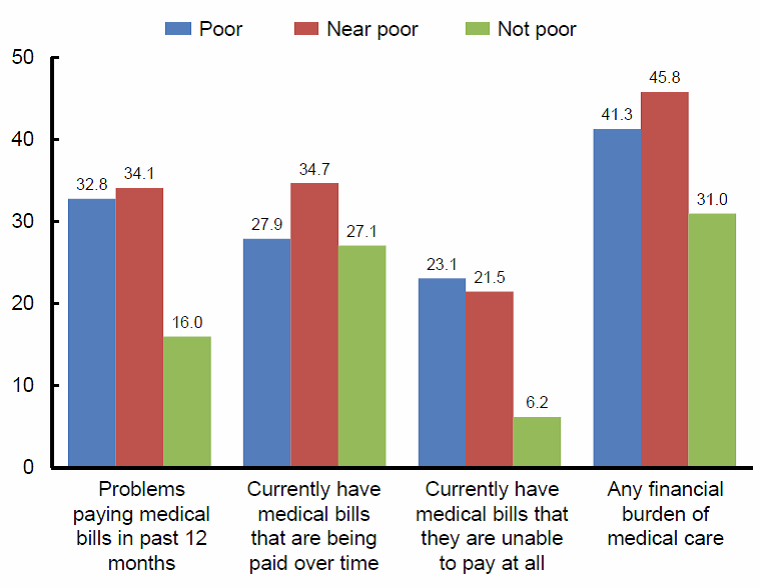

According to a CDC study, about 1/3 of American families either struggled to pay medical bills in 2011 or outright couldn’t pay them!

Not surprisingly, this problem is especially big for people with limited financial resources:

Just another piece of evidence in favor of something I’ve been talking about lately when giving public lectures: that physicians need to discuss the cost of care with patients before prescribing treatment.

(Click here to view comments)