There’s lots to love about American healthcare. We have some of the best clinicians in the world, as evidenced by the huge number of people who come to the U.S. from other countries when they are sick. Yet the American people are less satisfied with their healthcare system than are citizens of the majority of other developed countries.

Why do people in the land of the Mayo Clinic and Mass General Hospital hate their healthcare system so much? In short, many Americans are upset that they cannot afford to make use of all this high quality care when they need it.

(To read the rest of this article, please visit Forbes.)

If You Don’t Have Employer Insurance, You Probably Have a High Deductible

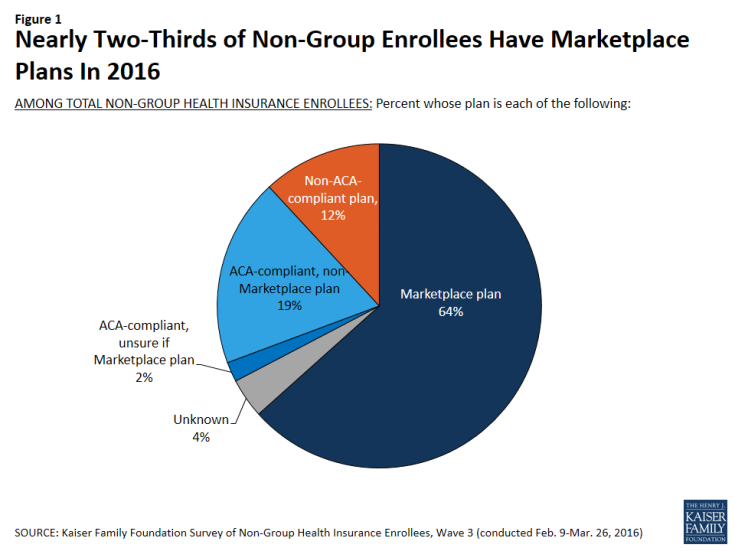

Most people in the United States get health insurance either through their employer or through government programs like Medicare and Medicaid. But some people have to find other ways to get healthcare insurance, with an increasing number of people doing so through the Obamacare exchanges, or “marketplaces.” In fact, according to the Kaiser Family Foundation nearly 2/3 of people in this situation can thank the Affordable Care Act for their access to healthcare insurance:

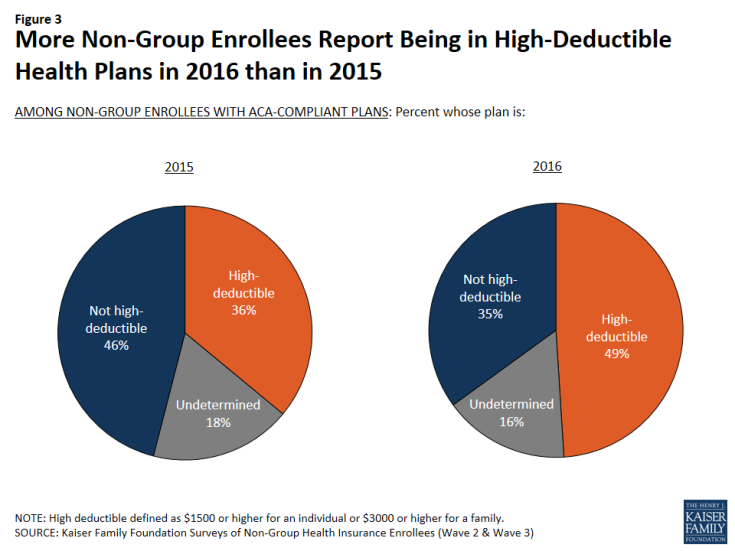

With increasing frequency, when people purchase health insurance through things like the exchanges, their purchasing plans have high deductibles:

15 years ago, if I told you that a president came into office, instituted a marketplace for healthcare insurance, a marketplace that caused an increasing percentage of Americans to end up in high deductible “consumer directed health plans” – you’d have told me that must have been a Republican president. Go figure.

Your Physician Can't See You Yet – She's Busy Filling Out Paperwork!

Left to our own devices, most of us physicians try our best to provide high quality care to our patients. But almost none of us provide perfect care to all of our patients all of the time. In fact, many of us get so caught up in our busy clinic schedules we occasionally forget to, say, order mammograms for women overdue for such tests, or we don’t get around to weaning our aging patients from unnecessary and potentially harmful medications.

Because the quality of American medical care is often uneven, third-party payers – insurance companies and government programs like Medicare – increasingly measure clinician performance and reward or punish physicians who provide particularly high or low quality of care.

The result of all this quality measurement: gazillions of hours of clinic time spent documenting care rather than providing it.

According to one study, in fact, clinic staff spend more than 15 hours per week dealing with quality measures for every physician in the practice. In other words, a six-physician clinic group can expect 90 hours of staff time spent documenting quality performance. And it’s not just the staff that are left to do such documentation. Physicians spend precious time in such activities, too. The same study estimates that physicians spend almost 3 hours per week documenting the quality of their care. Here’s a picture of that finding:

Is it any wonder why so many American physicians report being burned out by their jobs?

To read the rest of this article, please visit Forbes.

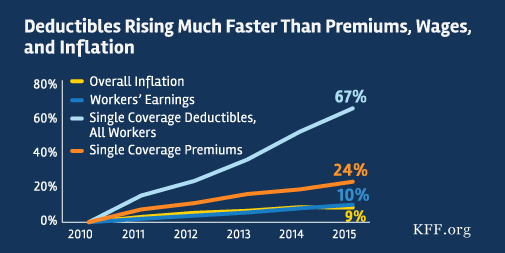

Inflation Crawls While Deductibles Sprint Ahead

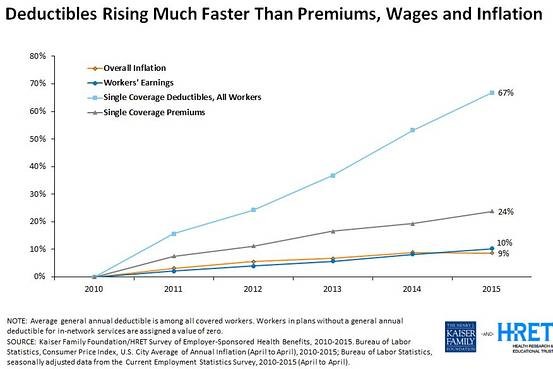

With increasing frequency, Americans are purchasing health insurance plans that require high out-of-pocket costs. Chief among those costs are deductibles, the amount of money a person or family must spend out-of-pocket on medical care in a year before their health insurance “kicks in.” As this figure illustrates, from the Kaiser Family Foundation, deductibles have been rising much more quickly than overall inflation, than incomes, and than the cost of their health insurance premiums.

Because of these high deductibles, January and February have become months where many people, when faced with illness, are also faced with burdensome healthcare bills.

Because of these high deductibles, January and February have become months where many people, when faced with illness, are also faced with burdensome healthcare bills.

Where Your Paycheck Is Going

If you are wondering why your hourly wage or your salary aren’t rising as quickly as you like, or why your bank account at the end of the year hasn’t grown as much as you intended, don’t forget to take into account just how much more you are probably paying out-of-pocket for the medical care you receive each year. Here’s a picture from the Kaiser Family Foundation, showing that deductibles are rising much faster than insurance premiums and, sadly, than our wages:

Rumors of the Obamacare Death Spiral Have Been Greatly Exaggerated

For a while last fall, it looked like the Obamacare health insurance exchanges were spinning towards a death spiral. Enrollment in the health insurance exchanges was not growing as rapidly as many people had hoped. United Healthcare, one of the nation’s largest insurers, announced that it intended to pull out of the exchanges soon, convinced that there are not good profits to be made in that marketplace. The company even decided to cut commissions for insurance agents who direct consumers to the exchange. Some experts warned that the exchanges are entering what policy wonks call a “death spiral,” whereby insurance premiums would rise each year, forcing relatively healthy people out of the market, causing premiums to rise again the next year, and so on.

With a few months of enrollment figures now behind us, it is safe to say that rumors of an Obamacare Death Spiral have been greatly exaggerated. While the health insurance exchanges still face many challenges, they appear to be holding steady, and with a few modest policy changes could transform into a robust marketplace.

The healthcare exchanges were established by Obamacare as places people can go to shop when they don’t receive insurance through their job or through the government. The exchanges are a major method through which the law expands the private health insurance market. But as new markets, they are risky places to do business. With employer-based insurance, insurance companies have had decades to figure out how to price their premiums. But with these new markets, they have been forced to base initial prices on their best guesses of how many people would sign up through the exchanges and, even more critically, of how sick those people would be. If only the sickest of the sick sign up, then premiums need to reflect the high cost of covering their predictably high healthcare needs.

New evidence is out showing just how sick those early enrollees were. But even more importantly, the evidence shows that with the passing of each month, new enrollees have been coming from healthier and healthier stock. If these trends continue, the price of premiums should soon settle into much more affordable territory, and the rise in premiums from year to year should become much less significant.

What evidence supports these conclusions? (To read the rest of this article, please visit Forbes.)

Is Your Company Using Health Insurance Premiums To Stigmatize Fat Employees?

Many companies spend lots of money providing health insurance coverage to their employees. And the costs of that coverage continue to rise, in part because the girth of the American public is also rising. Overweight and obese employees cost companies money, through increased sick leave, disability claims and, of course, healthcare expenses. As a result, some companies levy additional insurance premiums for overweight and obese employees, both to encourage them to lose weight and also to cover the greater expected costs of their benefits. Are such premium hikes fair? Do they unduly stigmatize obese employees?

Consider two companies. One raises health insurance premiums for obese employees; the second offers a discount on health insurance premiums for employees who are not obese. Is the second company’s policy fairer?

On the surface, this seems like a silly question. Both companies charge overweight and obese employees more money for their health insurance than they charge other employees. But according to a recent study, many people prefer the second company’s approach to the first. They think the first company, in increasing premiums for obese employees, must think negatively about such people.

As behavioral economics has taught us: framing matters. (To read the rest of this article, please visit Forbes.)

Talking To Your Doctor About Out-Of-Pocket Costs Can Save You Money

Healthcare is often really costly. And with increasing frequency, a significant chunk of those costs is being passed on to patients in the form of high deductibles, copays, or other out-of-pocket expenses. As a result, millions of Americans struggle to pay medical bills each year.

What’s a poor patient to do?

For starters–they can talk to their doctors about these costs. According to a study my colleagues and I just published, when healthcare costs come up for discussion during clinical appointments, doctors and patients increasingly discuss strategies for how to lower out-of-pocket expenditures.

In the study, we analyzed transcripts of almost 2,000 outpatient clinical appointments, appointments audio recorded and transcribed by Verilogue Inc., a marketing research firm whose CEO, Jamison Barnett, was generous enough to collaborate with us on this research. (Full disclosure: All the doctors and patients gave permission to be audio recorded by the company. Verilogue removed all identifying information from the transcripts. And my colleagues and I did not enter into any financial relationship with the company, nor cede any control over our right to publish our findings.)

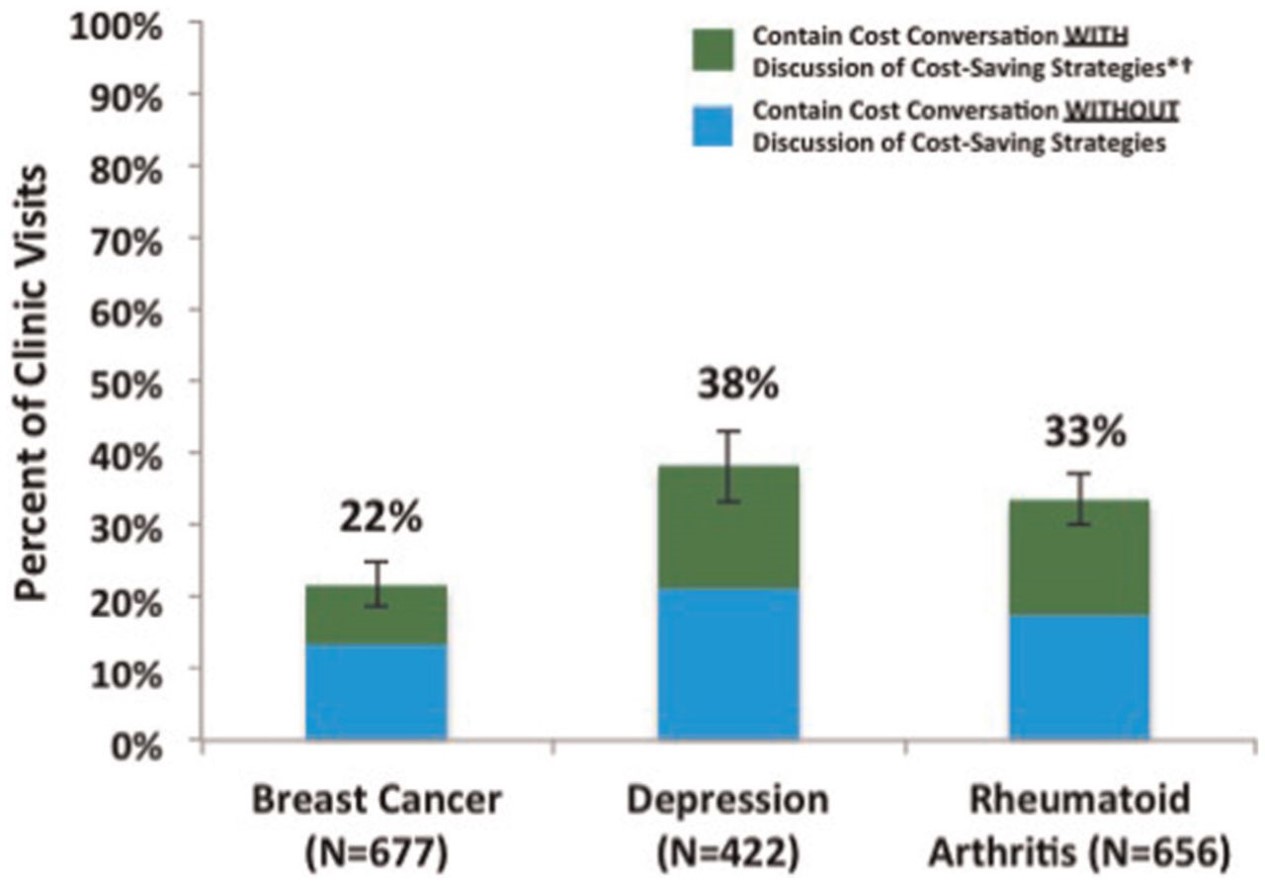

We analyzed three groups of patients, all of whom potentially face high out-of-pocket costs: breast cancer patients seeing their oncologists; rheumatoid arthritis patients seeing their rheumatologists; and patients with depression seeing their psychiatrists. We looked for any conversation that touched on the topic of healthcare costs–from discussions of whether insurance would “cover” a specific service (or whether the patient would instead be responsible for its cost) to patient complaints about out-of-pocket costs they’d already incurred from services ordered by their doctors during previous appointments.

In the first article published from these analyses (recently released on the website of Medical Decision Making), we focused on the strategies doctors and patients discuss to reduce patient out-of-pocket costs. And what did we find? That discussion of cost-reducing strategies was both common and rare. Common, in that once healthcare costs came up in the conversation, discussion of cost-reducing strategies occurred almost 40% of the time. Rare, in that healthcare costs came up as a topic of conversation in only 22-38% of the out-patient visits, meaning that in the majority of encounters, there was no discussion of healthcare costs, and thus no discussion of how to reduce patients’ out-of-pocket expenditures. Here is a picture showing those findings:

Sometimes doctors and patients found ways to reduce out-of-pocket costs without changing the plan of care. For example, doctors would refer patients to copay assistance programs, or give them free medication samples. Sometimes they would play around with the logistics of care, moving an expensive test up to December rather than January, so that the patient would not have to start spending through her deductible again.

(To read the rest of this article, please visit Forbes.)

Should Presidential Candidates Be Vilifying Physicians For The High Cost Of Medical Care?

When asked what enemies she was proud to have made during her political career, Hillary Clinton mentioned, in order, “the NRA, the health insurance companies, the drug companies [and] the Iranians.” Pretty villainous company to place healthcare industries into. But Clinton is not alone among presidential candidates in vilifying pharmaceutical and insurance industries for, as Bernie Sanders puts it, “ripping off the people.” Donald Trump called pharmaceutical profiteering “disgusting” and claimed that “insurance companies are making a fortune because they have control of the politicians.” Marco Rubio blamed high drug prices as “pure profiteering” by pharmaceutical companies. It is a strange world when Republicans join Democrats in vilifying people and companies who pursue profits through the marketplace.

Even stranger, neither party is taking aim at a group of people in the healthcare industry who have been making a fortune by exerting enormous influence over healthcare spending. No one seems to be vilifying physicians.

Yet if candidates are looking to blame someone for high healthcare costs in the United States, they should include physicians, whose decisions–to order tests or treatments–are responsible for the bulk of healthcare spending. Yes, pharmaceutical companies are charging exorbitant prices for many of their products. But patients do not receive expensive medications unless physicians prescribe them. True, insurance premiums are very expensive and rising rapidly. But those premiums reflect the cost of paying for all those services that physicians order for their patients. And some of those services reflect physician fees, which for some subspecialists are quite high. Many American physicians are extremely well paid for their work, with the median allergy doctor making almost $300,000 a year, and the median gastroenterologist making almost $400,000. Indeed, American physicians often take home 50 to 100% higher annual incomes than their peers in Europe or Canada.

So why aren’t politicians vilifying physicians? Because when they turn their attention to the role of physicians in driving up healthcare costs, candidates shift from blaming people to blaming the system. When laying out her healthcare plans, for example, Clinton remarks that “we need to shift away from the fee-for-service payment system that rewards providers who prescribe excessive tests and unnecessary procedures.” Jeb Bush also criticizes the reimbursement system, complaining that “providers are not being held directly accountable to patients for the value of the care they deliver.”

When pharmaceutical and insurance companies drive up healthcare costs, they are villainous. When physicians drive up costs–it is the system that is to blame!

(To read the rest of this article, please visit Forbes.)

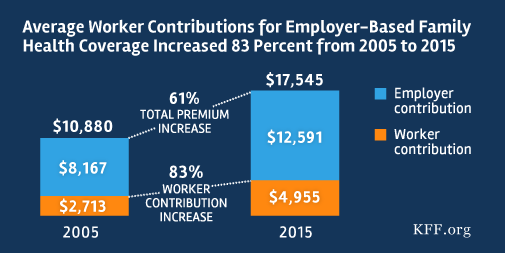

A Health Insurance Double Whammy

In case you missed it, I am recirculating a picture put together by the Kaiser Family Foundation , which reveals two unsettling facts about health insurance in United States.

First, the cost of employer-based health insurance has risen 61% since 2005. When health insurance premiums rise, salaries don’t. That’s a problem.

Second, worker contributions have risen even faster than overall premiums, increasing 83% over this period of time.

We have tremendous income inequality in this country that arises for a whole host of reasons. Healthcare costs are making this problem worse, by diverting money away from people’s take-home pay in order to cover the rising costs of health insurance.

Sorry if that is a bit of a downer.