Home - Peter Ubel

Latest Content

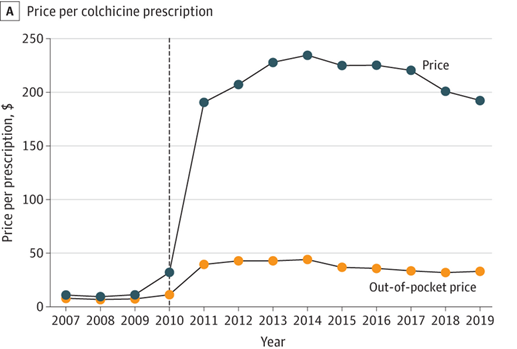

The Verdict Is In—Price Gouging Harms People With Gout

Published Mar 05, 2024

The patient arrived in my clinic, their right big toe the color of a spring strawberry. The lightest touch caused exquisite pain. Fortunately, I was able to prescribe a pill (an ancient medicine, actually) and the patient was better by the next day.

Too bad that simple treatment is becoming unaffordable, through a maddening combination of greed and regulatory failure.

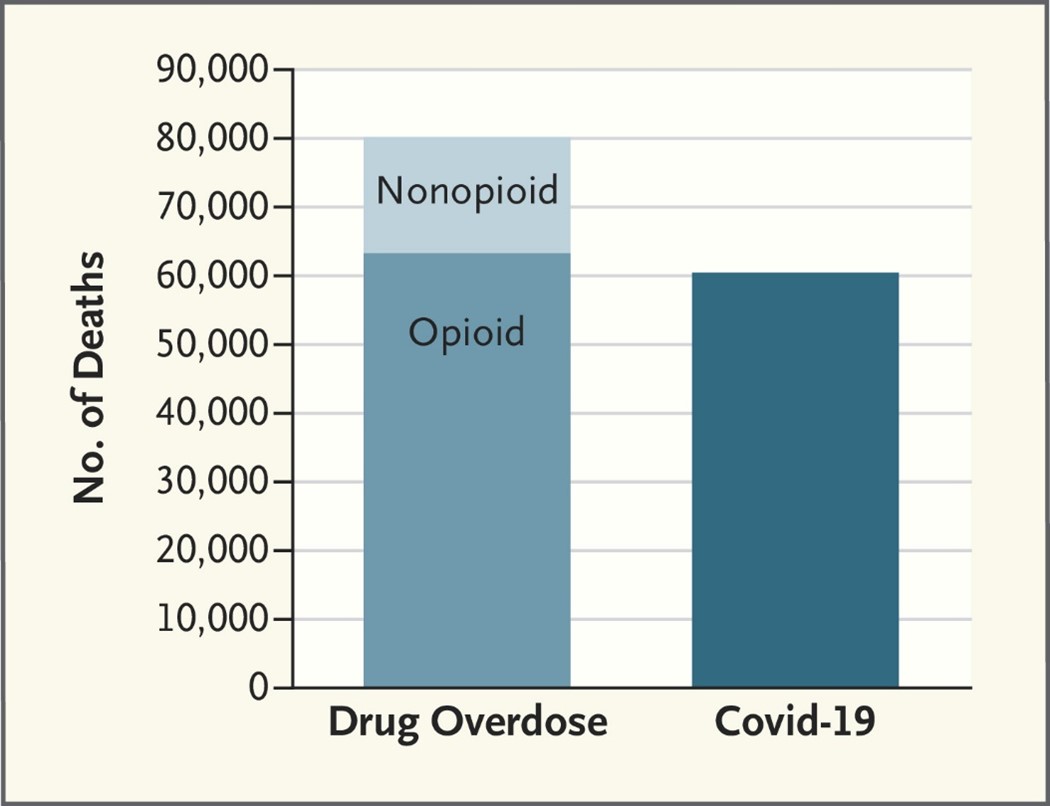

Read MorePeak Pandemic–Guess What Was Killing More Young Americans Than Covid-19

Published Jan 23, 2024

Covid-19 killed approximately 60,000 young Americans between 15 and 54 years old in 2021. By any measure, that is an awful statistic, representing a staggering number of loved ones lost to the virus.

But as awful as that statistic is, guess what killed even more young Americans.

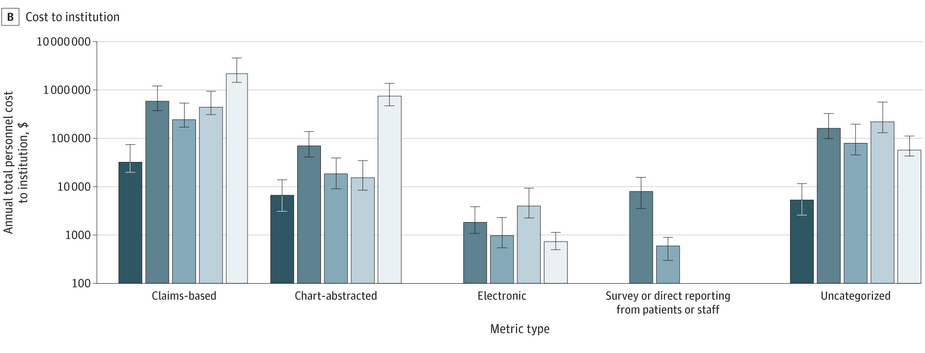

Read MoreThe Crushing Cost Of Tracking Healthcare Quality—One Hospital’s Story

Published Dec 14, 2023

A whole industry is devoted to measuring, tracking and even incentivizing the quality of American hospital care. Unfortunately, that industry is horribly inefficient, costing us billions of dollars.

Quality measurement is inefficient in large part because there is no single source that hospitals (and provider systems, more generally) can use to track the quality of their care.

Read MorePreventing Diabetes – What Medicare Administrators Could Learn From Shark Tank

Published Nov 10, 2023

The Medicare Diabetes Prevention Program is a lifesaver. Consisting of of at least 16 class sessions that provide practical training about healthy eating, physical activity, and other strategies for weight control, the Program reduces the chance that people at high risk for diabetes actually develop that life-threatening condition.

However, the Program is floundering, with distressingly few people having access to or enrolling in the program. Could it be because Medicare administrators haven’t watched enough episodes of Shark Tank?

Read MoreDrugs Are Outrageously Expensive—Canada Found A Way To Fight Back

Published Oct 27, 2023

Latuda is a drug to treat schizophrenia. It costs about $4,000 per month in the U.S. In Canada, the price is closer to $500.

Ibrance, a breast cancer drug, costs $10,000 more per month in the U.S. than in Canada.

Why these enormous price differences?

Read MoreGetting What You Want At The End Of Life – Lessons From A Dying Man

Published Oct 05, 2023

Many people die in ways, and even in locations, that go against their preferences. They don’t want to be put on ventilators and, yet, spend their last days in intensive care units tethered to breathing machines. They don’t want cardiopulmonary resuscitation (CPR), and, yet, receive full-on “codes” when their hearts stop.

Much of this unwanted care could be avoided if patients (aka: “people”) discussed their treatment preferences with their clinicians.

Read More