Dick Thaler, an economist who helped create the field of behavioral economics, came up with a wonderful idea a long time ago to promote retirement savings, a plan he calls Save More Tomorrow. Among the many clever aspects of his plan is the idea of automatic escalation of people’s retirement contributions. Think of the idea this way. I might hope to put, say, 5% of my savings aside for retirement each year. But I’m not saving anything right now. So to go from 0 to 5% in one year would be difficult, and I would feel like I lost a lot of my take-home pay. Thaler’s idea is for me to commit to growing my retirement savings rate, by deciding right now to let it increase in the ensuing years, automatically. In other words, if I don’t do anything else again, my retirement savings will go up.

Another part of his idea is to get people automatically enrolled in retirement saving plans, while leaving them the option of opting out. In traditional retirement plans, people have to decide whether to maximize their retirement savings, and if they put off the decision, they end up not contributing anything to retirement. Save More Tomorrow flips this situation. It asks people to decide whether they don’t want to save for retirement, and if they put off the decision, they end up contributing maximally to the retirement plan.

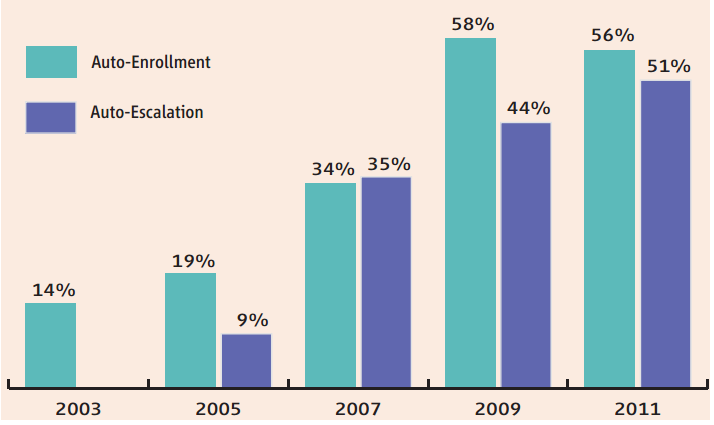

As the graph below shows, which I got from this wonderful website at the University of Stirling, this plan is really catching on:

Amazing what a little bit of psychology can do to improve people’s economic behavior.

(Click here to view comments)