Paying Doctors Less Is the Key to Better Coverage

Conservatives propose to control healthcare costs by bringing the discipline of the free market to bear upon the healthcare system. Some progressive groups advocate controlling costs with a more interventionist plan. But neither approach, as far as I have seen, adequately confronts one of the biggest barriers to controlling healthcare costs—the strong psychological desire physicians like me have to maintain our often phenomenally high incomes.

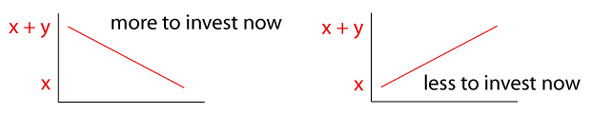

To help you understand this psychological phenomenon, I want you to imagine that you have ten years left in your career, and can choose between the following two income streams over those ten years: In the rising salary stream, you would start at salary X, and then receive a steady raise in your salary over the next ten years till you finish at salary X+Y. In the falling salary stream, you’d start right now at an salary of X+Y, and your salary would steadily decline across the ten years to end at salary X. Both choices would leave you with the exact same amount of salary over these ten years, only differing on whether your salary grows over time or declines.

What would you choose?

When I was given this hypothetical choice, I chose the increasing salary stream. I wanted to see my earnings get bigger over time, not watch them fall. Behavioral economist George Loewenstein created this hypothetical choice to illustrate an irrational side of human nature. You see, if I had been rational, I would have chosen the falling salary stream, because in theory I could have invested some of that early money and watched the interest compound over the ten years, leaving me richer at the end of the day than with the strategy I chose. Reason, in my case, lost out to instinct.

Most people, when given this hypothetical choice, are like me and choose the increasing salary. Most of us feel that our incomes are supposed to rise from year to year. The thought of watching our paychecks shrink over time goes against our instincts.

Recent battles over President Bush’s proposal to reign in Medicare costs revealed the power of this instinct. The Bush administration wanted to control costs in part by reducing physician reimbursement. On one level, the political battle was straightforward: A powerful interest group (physicians) stirred up fears to enrich itself. But on another level, the battle was more subtle. Physicians in this case weren’t after more money. They were trying not to lose money.

Daniel Kahneman won the Nobel Prize in part for elucidating people’s powerful psychological desires to avoid losses. (He conducted much of this work with Amos Tversky, who unfortunately died before the Nobel was awarded.) Kahneman and Tversky showed that people feel much worse about a modest loss than they feel good about a similarly-sized gain. In fact, people look more favorably upon a surgical intervention with a 90 percent survival rate than on one with a 10 percent mortality rate, even though there is no difference between the interventions. The mere framing of a choice as potentially involving a loss (of money, of life) triggers strong negative emotions. Human beings are hardwired with an aversion to losses.

Here’s the challenge raised by this psychological phenomenon: If we as a society want to control healthcare costs, one of the things we need to do is control physician income, which in the United States dwarfs that of most other advanced countries. (The most egregious physician incomes are generally earned by procedural specialists, with other groups, such as primary care pediatricians, receiving much more modest incomes.) But if we threaten to reduce physicians’ incomes, we will face tremendous resistance. Psychological resistance. Physicians won’t want to see their incomes go down.

The only way to control physicians’ income is to allow their income to grow over time, while controlling the rate of growth so that physicians’ incomes fall in relation to inflation. An oncologist making $400,000 last year (yes, that’s a pretty common income for such physicians) will probably fight aggressively to keep someone from reducing his income to $395,000 this year. Now, if through a new Medicare plan his income grows 1 percent this year, a rate significantly less than inflation, he will make $404,000. Psychologically speaking, he will feel like his income is growing, and he will probably be less likely to become politically active fighting the plan.

There’s another reason people fight hard to keep their incomes from declining: they often buy homes based on their income expectations. I’m not asking anyone to feel sorry for an orthopedic surgeon who, due to a loss of income, is forced to downsize from his 6,000 square foot home. But I am asking you to imagine yourself in that person’s shoes: you’ve bought your dream house and now, because of a shift in Medicare policy, you may have to move to a smaller house. How hard will you work to maintain your income? Will you donate money to a lobbying organization that will fight the Medicare plan? Will you buy a radiology practice, so you can start making money on your patients’ x-rays? Will you start operating on patients more often, including on elderly people who, in the past, you would have referred to a physical therapist?

Any politician who wants to change the healthcare system should heed the psychological power of loss aversion. Not to do so is a recipe for failure.