In a few months, we will find out whether the Supreme Court has decided that a critical part of the Affordable Care Act is unconstitutional. If that happens, lots of people will be in lots of trouble, financially speaking. Here is a wonderful article in a North Carolina newspaper laying out some of the issues for citizens of this wonderful state:

In a few months, we will find out whether the Supreme Court has decided that a critical part of the Affordable Care Act is unconstitutional. If that happens, lots of people will be in lots of trouble, financially speaking. Here is a wonderful article in a North Carolina newspaper laying out some of the issues for citizens of this wonderful state:

A case before the U.S. Supreme Court could threaten the ability for more than a half-million North Carolinians to afford their health insurance.

In North Carolina, more than 560,000 people have enrolled in health coverage through the federal Health Insurance Marketplace, nearly all of whom have done so with the promise of help paying their monthly premiums in the form of subsidies from the federal government.

Based on final enrollment figures released Tuesday by the U.S. Department of Health & Human Services, 92 percent of customers received monthly subsidies at an average of $315. That’s about 515,500 North Carolinians eligible for $162.4 million to help pay their premiums each month, and almost $1.95 billion in 2015.

But the legal mechanism through which this money flows is the subject of a lawsuit under consideration by the nation’s high court. A ruling to uphold the claim in King v. Burwell could revoke the Internal Revenue Service’s ability to give advance premium tax credits – essentially subsidies paid directly to insurance companies – to customers in states that do not run their own exchanges.

The question before the court is whether an insurance exchange set up by the secretary of Health & Human Services in the event a state does not can receive those subsidies the law says can be provided for plans purchased through an “exchange established by the state under section 1311” of the Affordable Care Act.

In North Carolina, where lawmakers chose not to create a state insurance exchange, a ruling in favor of the plaintiffs would mean residents who have purchased insurance with the help of subsidies would no longer be eligible for that financial assistance unless the General Assembly opted to create an exchange or Congress stepped in to tweak the law’s wording.

Health policy experts in the state are quick to say there is a great deal of uncertainty about how the court might rule and what conditions could be applied to a ruling, particularly one in favor of the petitioners.

But for the North Carolina residents who would lose their subsidies, Jonathan Oberlander can sum it up in one word: devastating.

(To read the rest of this article, please visit The Fayetteville Observer.)

Jonathan Gruber went from unknown to infamous in the last few weeks, a result of

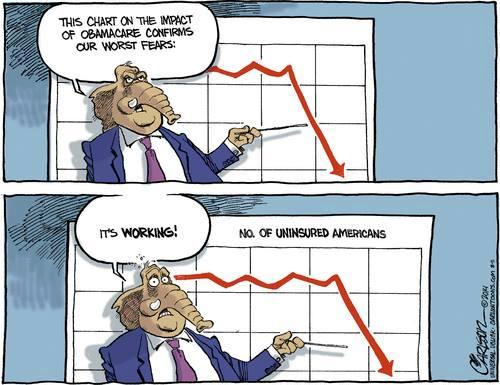

Jonathan Gruber went from unknown to infamous in the last few weeks, a result of  For all its flaws, Obamacare has done more to increase access to health insurance than any government program since Medicare.

For all its flaws, Obamacare has done more to increase access to health insurance than any government program since Medicare.